Term Insurance Meaning Features and Advantages. Read more to find the one that works for you.

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

They are a non-renewable resource ie once used they cannot be replaced.

. With term life insurance you pay premiums for a specified term usually 20 or 30 years and if you die within that term the insurer pays your survivors a benefit. Term life insurance pays only if the insured dies within the defined term such as 10 20 or 30 years. Life insurance rates go up as you get older so think about locking in lower rates now.

All You Need To Know About Term Insurance Plan Benefits. Harvesting of fossil fuels also causes fatal diseases among the people. Life insurance companies look at your family and health history to determine policy cost.

Different life insurance products can provide different advantages. If the insured dies during the term of the policy life insurance plans pay a death benefit. In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language.

One of the biggest advantages of a term insurance plan is that these policies are easily available online. If you stop paying premiums you could lose your coverage just like any other policy. Typically term insurance is the most affordable type of coverage with flexible premiums based on your coverage length and amount.

In insurance the insurance policy is a contract generally a standard form contract between the insurer and the policyholder which determines the claims which the insurer is legally required to pay. Life insurance ASCE members are eligible for. Term Life Insurance As the name.

For eg the coal miners often suffer from Black Lung Disease. Term life insurance from Nationwide is affordable predictable and flexible. For coverage amounts up to 100000 Base Policy.

Financial protection for your family if the unexpected happens. The named beneficiary receives the proceeds and is thereby safeguarded from the. Standby cash for the family and you into the best years ahead.

Life Insurance Cash benefits for your family in case of death. Term life insurance. Can provide affordable high-coverage protection for a specific period of time or term.

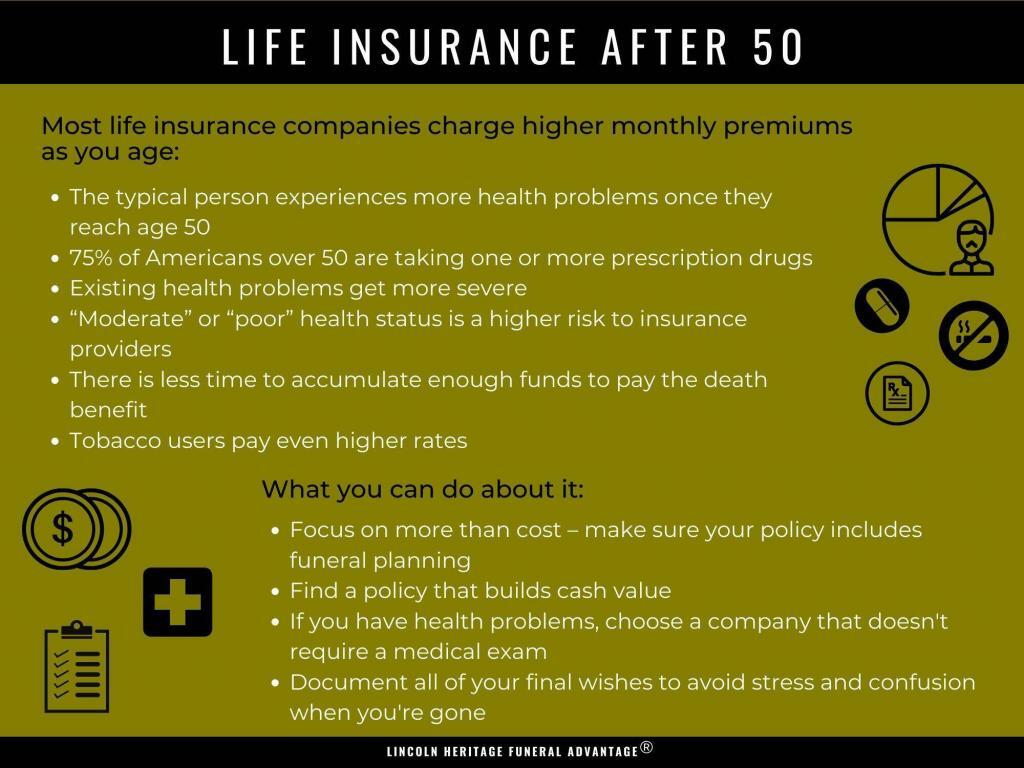

Products for people over age 50 and compared their policy options and riders to find the ones offering the most advantages flexibility. Now have access to an exclusive 05 rate discount when refinancing their student loans. 20-year or 30-year terms and is renewable each year until age 95.

30 35 40 45 50 55 60 65 70 and 75. It can be converted to a permanent life insurance policy during the term period up to age 65. Renewable term life insurance is a life insurance policy offering a death benefit for a set premium and a limited time.

Further existing insurance. High-limit accident disability hospital indemnity long-term care and pet insurance all at affordable rates. Combustion of fossil fuels makes the environment more acidic.

The two main types of life insurance are term life insurance and whole life insurance. People use this type of policy when they need to have coverage on a temporary basis. Universal life insurance often shortened to UL is a type of cash value life insurance sold primarily in the United StatesUnder the terms of the policy the excess of premium payments above the current cost of insurance is credited to the cash value of the policy which is credited each month with interestThe policy is debited each month by a cost of insurance COI charge.

Waiting Period This is the time during which you cannot claim any benefit offered by an insurance company. Health Insurance Emergency cover for hospitalisation treatment and your recovery. Renewable Principal Officer.

Term insurance Plan Benefits. Advantages of term life Disadvantages of term life. Renewable to age 80.

Life insurance is a protection against financial loss that would result from the premature death of an insured. Life insurance policies are designed to cover the risk of premature death. But term insurance is similar to car insurance.

Yearly Renewable Term This is a type of short-term insurance policy that offers insurance. This has led to unpredictable and negative changes in the environment. The policy owner should be the sole decision-maker after being fully informed about the advantages and disadvantages of the transaction.

If you want to exchange your current life insurance endowment or annuity policy to a new policy a 1035 Exchange just might be a great tax-deferred option for you to consider.

Affordable Over 50 Life Insurance Quotes What S Best For You

Annuity Vs Life Insurance Similar Contracts Different Goals

All The Ins Outs And How To S Of Life Insurance Simplified And Explained For You Life Insurance Life Insurance Marketing

Benefits Of Long Term Health Insurance

What Is Term Life Insurance Forbes Advisor

Voluntary Life Insurance Quickquote

Types Of Life Insurance Fidelity Life

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

Types Of Life Insurance Fidelity Life

Simple Affordable Life Insurance Policies Ethos Life

What Gerber Life Product Is Right For You Life Insurance Policy Infographic Life

What Is Term Life Insurance Policygenius

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

How Does Life Insurance Work Forbes Advisor

Group Life Insurance Life Insurance Glossary Definition Sproutt

Difference Between Term Insurance And Whole Life Insurance Whole Life Insurance Life Insurance Facts Life Insurance